AI’s Economic Deflation in 25 yrs : Insight by Vinod Khosla

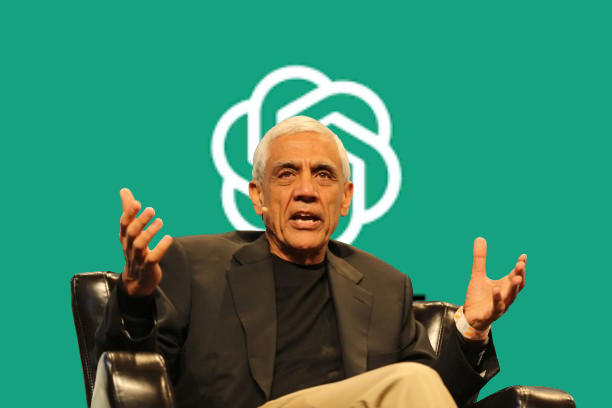

In the realm of AI’s potential, Vinod Khosla, a prominent Indian American businessman and OpenAI investor, envisions a transformative shift in the global economy. His recent commentary on X underscores the profound implications of AI’s rapid ascent. Khosla, echoing Stanford Digital Economy Lab director Erik Brynjofsson, predicts a deflationary trend attributed to AI within the next 25 years.

The Rise of AI in Global Economy

AI’s evolution is poised to reshape industries, economies, and societal norms. Vinod Khosla’s perspectives underscore the monumental implications of AI in global economic paradigms.

Khosla’s Vision for AI

Drawing from his investment experiences and industry insights, Khosla emphasizes the game-changing influence AI will exert on economic structures worldwide. His observations spotlight the impending significance of AI-driven transformations.

Erik Brynjofsson’s Corroborating View

Khosla’s viewpoint gains weight through Erik Brynjofsson’s collaborative affirmation. The convergence of their opinions fortifies the prognosis of AI-induced deflationary patterns in the coming decades.

AI and Economic Deflation

Khosla and Brynjofsson’s outlooks converge on the belief that AI’s proliferation will induce economic deflation. This collective prognosis signals a paradigm shift in economic dynamics.

The 25-Year Forecast

Their foresight extends across a 25-year horizon, anticipating AI’s transformative influence on economic structures, productivity, and societal dynamics.

Navigating AI-Driven Changes

Understanding these predictions prompts a proactive approach to navigate the anticipated economic landscape shaped by AI’s advancements.

Understanding AI’s Deflationary Impact on Economics

AI’s Deflationary Effects

AI’s proliferation is anticipated to significantly impact economics. Vinod Khosla’s tweet posited that AI would create deflation, impacting capital availability and redefining traditional GDP measures.

AI’s Deflationary Influence

Khosla’s Insight

Vinod Khosla’s tweet highlighted AI’s anticipated deflationary impact over a 25-year period. He suggested a scarcity of capital, decreased GDP relevance, but an abundance of goods and services.

Shifting Economic Parameters

Relevance of Traditional Metrics

Khosla’s remark raised questions about the validity of current economic measures in the face of AI-induced changes. The tweet emphasizes the necessity to identify suitable parameters for evaluating economic performance.

Reevaluating Economic Indicators

Determining the Right Measures

The tweet prompts considerations regarding suitable economic evaluation tools in the AI-driven era. It underscores the importance of redefining metrics to accurately assess economic growth and well-being.

Implications for Capital and Innovation

Capital Scarcity and Innovation

Khosla’s forecast of capital scarcity intertwines with AI’s deflationary trend. This anticipation heralds a shift in capital deployment and sparks discussions on fostering innovation amidst evolving economic landscapes.

https://twitter.com/vkhosla/status/1739450804254519767

Venture capitalist Vinod Khosla forecasts a period of limited capital impacting traditional economic indicators like GDP. He suggests a shift where abundant goods and services will take precedence, redefining economic health. An alumnus of IIT Delhi, Khosla envisions machine learning’s role in job displacement, income disparities, yet fostering enough GDP for universal basic income. His hefty investment of $50 million in OpenAI positions him as a pivotal figure in ChatGPT’s genesis.

Tags: Economics, Vinod Khosla, Capital Limitation, GDP, Economic Health, Machine Learning, Income Disparities, OpenAI, ChatGPT, Venture Capitalist

Renowned venture capitalist Vinod Khosla forecasts a distinct economic paradigm where limited capital will prompt a reevaluation of traditional economic metrics. He emphasizes the potential decline in relevance of customary indicators like GDP and economic health while advocating for a scenario featuring an ample supply of goods and services.

An esteemed alumnus of IIT Delhi, Khosla, recognized as the 92nd position holder on the Forbes 400 list in 2021, boasts a remarkable entrepreneurial journey. Founding Khosla Ventures and co-founding Sun Microsystems, his insights carry significant weight in the business and tech realms.

Khosla’s past remarks on machine learning’s transformative role echo his predictions of job displacement and amplified income disparities. However, he maintains a pragmatic viewpoint, foreseeing the generation of sufficient GDP to enable universal basic income, a concept crucial for societal stability.

The venture capitalist’s investment of $50 million in OpenAI during 2019 solidified his stature as one of the primary backers of the startup pivotal in crafting ChatGPT, a milestone in AI language generation technology.

Khosla’s forward-thinking perspectives challenge conventional economic ideologies, igniting debates regarding the future trajectory of economic health and the validity of established parameters. His foresight nudges us to reevaluate economic models, emphasizing the evolving dynamics catalyzed by innovative technologies and investment strategies.